IP Wealth blends proven expertise with technology, offering risk-adjusted, tax-efficient, and diversified strategies. With 1,250+ clients and ₹260 Cr+ AUM, our focus is long-term, sustainable growth.

Clients Served Since Inception

Wealth Under Management

Returns Generated for Clients

Average IRR Across Investments

Plan for Life Goals

Comprehensive financial roadmaps, including retirement, estate, and tax planning so every stage of life is secure.

ISmarter Portfolio Growth

Diversified, risk-adjusted strategies across equity, debt, bonds, PMS, AIFs, and insurance - optimized for consistent returns.

Why choose IP Wealth

Building Wealth With Clarity & Confidence.

With 1,250+ clients and ₹260 Cr+ assets under management, IP Wealth combines proven expertise and cutting-edge technology to deliver wealth solutions that are transparent, tax-efficient, and built for long-term growth.

Trusted Expertise

Led by industry veterans with 20+ years of experience across ICICI, Reliance, and Aditya Birla, our leadership ensures strategies backed by knowledge and credibility.

Tailored Solutions

From retail investors to startups and HNIs, we build personalized portfolios aligned with unique financial goals and growth journeys.

Technology-Enabled

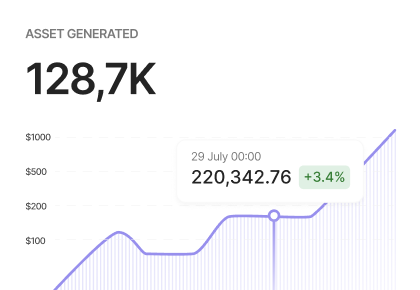

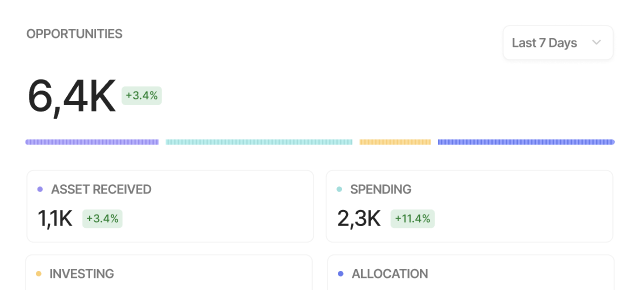

Seamless digital platforms provide 360° portfolio tracking, real-time insights, and effortless investing.

Proven Track Record

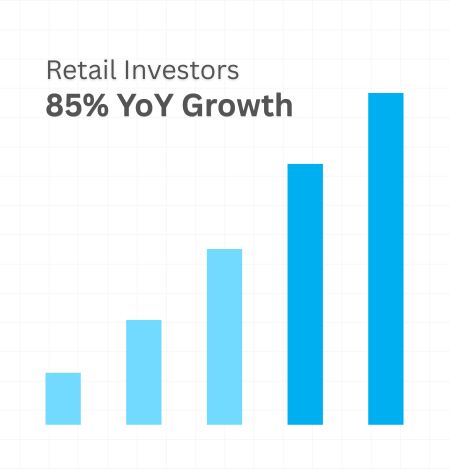

₹4,600 Cr+ returns generated, ~10.5% IRR delivered, and consistent YoY growth across all investor segments.

Services

Our Core Services

Wealth Management

Strategic portfolio construction, multi-asset diversification, and risk-adjusted investment strategies tailored to your goals.

Financial Planning

Comprehensive roadmaps covering retirement, estate, tax planning, and goal-based investments for every stage of life.

Fixed Income & Bonds

Access to high-quality listed bonds, private equity, corporate FDs, and curated NCD offerings with steady, predictable returns.

Alternative Investments

Premium access to AIFs, PMS, REITs, structured products, and early-stage opportunities for higher yield and diversification.

Services

Work Process

How IP Wealth Works

Step 1:Understand Your Goals

We start with detailed financial profiling - covering income, expenses, risk appetite, and long-term life goals like retirement or wealth transfer.

Step 2: Build Your Portfolio

Our experts design a tailored, risk-adjusted investment strategy across equities, bonds, insurance, PMS, AIFs, and tax-efficient products.

Step 3: Monitor & Optimize

With active monitoring, regular rebalancing, and technology-driven insights, your portfolio stays aligned with your goals and market conditions.

Our Team

Our Expert Team

Harsh Mirani

CEO (Chief executive officer)

Syed Uvais

COO (Chief Operating Officer)

Vaibhav Naidu

Director (Head of International Business)Subscribe for latest update

about Finance

FAQs

Frequently Asked Questions

1. What makes iPlan different from other wealth managers?

2. Who can invest with IPlan?

We serve a wide spectrum - retail investors (SIP & tax planning), HNIs (portfolio management), MSMEs (cash management), and startups (funding solutions).

3. What kind of returns can I expect?

While past performance doesn’t guarantee future results, IP Wealth has delivered an average IRR of ~10.5% across debt and equity strategies, with ₹4,600 Cr+ generated in client returns.

4. How does iPlan help with tax efficiency?

Our team uses tax-harvesting and structured investment strategies to minimize your tax outflow while maximizing post-tax returns.

5. Are my investments safe with IP Wealth?

Yes - we work only with regulated, high-quality issuers, across equities, bonds, PMS, AIFs, and insurance. We emphasize capital protection alongside growth.

6. Do you provide NRI investment solutions?

Absolutely. NRIs can access mutual funds, PMS, AIFs, and global opportunities through GIFT City, with full regulatory compliance.

7. How do I get started?

It begins with a simple financial profiling exercise. Once we understand your goals, we build a customized portfolio, monitor it actively, and rebalance when required.